When I first started investing in US tech stocks, Nvidia quickly landed on my radar. As one of the most dominant names in the semiconductor and AI space, its stock price has seen staggering growth over the years. But when Nvidia announced a stock split, I’ll admit—I wasn’t entirely sure how it would affect me as a UK-based investor.

If you’re like me and wondering what a stock split actually means—and how it might affect your portfolio—this guide covers everything I’ve learned about the Nvidia stock split, how it works, and what to expect if you hold shares from the UK.

What Is a Stock Split and Why Does It Happen?

At its core, a stock split is a way for a company to divide its existing shares into more shares, without changing the total market value of the company. It doesn’t mean the company is suddenly worth more—it just spreads that value over a larger number of shares.

For example, if a stock is trading at £800 per share and the company announces a 4-for-1 stock split, you’ll now own four shares worth £200 each. Your overall investment stays the same, but the number of shares in your portfolio increases.

So why do companies do this?

The main reasons are:

- Affordability: Lower share prices make it easier for everyday investors to buy in

- Liquidity: More shares in circulation can lead to higher trading volume

- Psychological appeal: £200 “feels” more accessible than £800—even if the value is identical

A reverse stock split, on the other hand, reduces the number of shares and raises the share price. That’s usually done to avoid being delisted or to meet stock exchange requirements—not a good sign.

In Nvidia’s case, the decision to split its stock was based on strength, not struggle.

Why Did Nvidia Split Its Stock—and Will It Happen Again?

The last Nvidia stock split took place in July 2021, and it was a 4-for-1 split. Back then, Nvidia’s stock had surged to nearly $750 per share, making it less accessible to retail investors. By splitting the stock, Nvidia lowered the price per share to around $187.50, which opened the door to a wider audience.

That move signaled confidence—and was largely seen as a positive development by investors and analysts alike.

Now, in 2024/25, Nvidia’s stock has once again climbed to eye-watering levels. With strong demand for AI chips, growing data center dominance, and massive revenue growth, some analysts are speculating that another split could be on the horizon.

While Nvidia hasn’t officially confirmed a new stock split, many investors (myself included) are watching closely. A new split could once again make the stock more accessible—especially if it crosses the $1,000 mark, which some forecasts suggest is possible.

What Happens to My Nvidia Shares After a Stock Split?

When Nvidia announced the split in 2021, I held a few shares in my UK trading account. I was a little nervous at first—I wasn’t sure if I needed to do anything, or if the shares would just update automatically.

Here’s what actually happened:

- On the effective date, my existing Nvidia shares were multiplied by four

- The price per share was adjusted accordingly, divided by four

- The total value of my investment didn’t change—just the number of units

- My UK broker (Freetrade) reflected the change automatically

- I didn’t have to take any action, pay fees, or file any forms

For example, if I had 1 share worth $800, I now had 4 shares worth $200 each.

If you’re dealing with fractional shares, they adjust too. My portfolio simply showed a higher number of fractional units, but the value remained exactly the same.

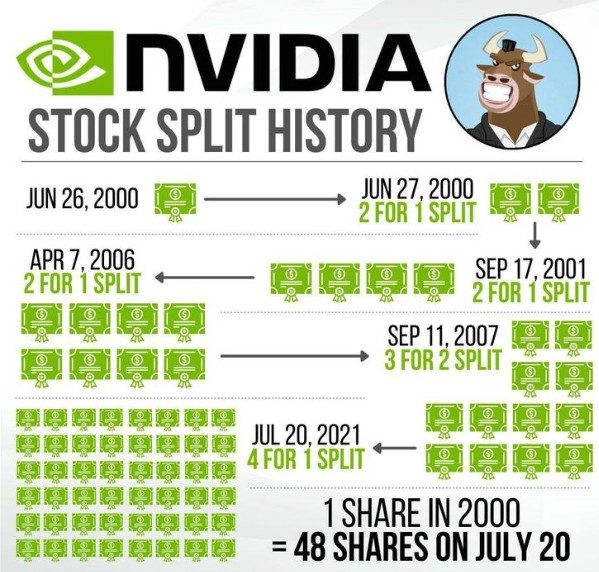

Nvidia Stock Split History and Performance

| Date | Split Ratio | Share Price Before | Share Price After | Reason for Split | Post-Split Performance |

|---|---|---|---|---|---|

| June 27, 2000 | 2-for-1 | ~$90 | ~$45 | Rapid growth in the graphics card market during the dot-com boom | Short-term volatility was followed by a strong recovery in the early 2000s |

| September 17, 2001 | 2-for-1 | ~$40 | ~$20 | Increase affordability after tech correction | Share price stabilized as Nvidia weathered dot-com crash |

| April 7, 2006 | 2-for-1 | ~$60 | ~$30 | Strong revenue growth and expanding product line | Continued upward trend throughout 2006 and into 2007 |

| September 11, 2007 | 3-for-2 | ~$38 | ~$25 | Broaden investor base and maintain trading volume | Modest performance before the 2008 global financial crisis |

| July 20, 2021 | 4-for-1 | ~$750 | ~$187.50 | Huge gains from AI/data center market and GPU dominance | The stock surged in the following months, driven by AI, gaming, and chip demand |

Detailed Explanation of Each Stock Split Event

June 27, 2000 – 2-for-1 Stock Split

At the peak of the dot-com boom, Nvidia was seeing explosive growth, particularly with its GeForce graphics cards. The company had captured a significant market share in the consumer GPU segment and wanted to make its shares more attractive to retail investors.

Although the dot-com crash soon followed, Nvidia’s core products remained in demand, and the company bounced back in the early 2000s thanks to its strong foothold in gaming and multimedia hardware.

September 17, 2001 – 2-for-1 Stock Split

This split occurred in a turbulent time—just days after 9/11 and amid ongoing uncertainty in global markets. Despite broader market fears, Nvidia proceeded with the stock split to maintain investor momentum.

This move was also aimed at long-term affordability, as the company continued to scale its operations. Nvidia’s products were increasingly being used beyond gaming, in enterprise and design applications, which helped steady the stock after the crash.

April 7, 2006 – 2-for-1 Stock Split

By 2006, Nvidia was thriving. It had secured its leadership in gaming GPUs and was making strides in mobile graphics and enterprise solutions. This split was prompted by Nvidia’s consistently rising share price, thanks to strong revenue growth and the success of the GeForce 7 and 8 series.

Investor demand was high, and the company used the split to make shares more accessible and maintain trading liquidity.

September 11, 2007 – 3-for-2 Stock Split

Rather than a full 2-for-1, Nvidia opted for a 3-for-2 split—meaning for every 2 shares you owned, you received an additional share (a 50% increase in share count). This was a slightly more conservative split, aimed at keeping the price reasonable while still expanding investor reach.

The company was entering new markets, including early efforts in automotive and mobile. However, this split was followed by the 2008 financial crisis, which impacted nearly every tech stock, including Nvidia.

July 20, 2021 – 4-for-1 Stock Split

This was Nvidia’s most recent and most publicised stock split. The company had become a household name, thanks to:

- Booming demand for GPUs in gaming

- Massive growth in AI and machine learning infrastructure

- Strategic positioning in data centers and cloud computing

Nvidia’s stock price had risen rapidly—from around $300 in 2020 to nearly $750 in mid-2021. The split brought the share price back down to around $187.50, making it more accessible to individual investors and boosting retail trading volume.

Following this split, Nvidia saw continued momentum—especially as demand for AI-related hardware exploded in 2023 and 2024. It became one of the top-performing tech growth stocks, with investor sentiment bolstered by its visionary leadership and dominance in next-gen semiconductors.

Is a Stock Split Good or Bad for Investors?

In my opinion—and based on what I’ve experienced—it’s usually a positive event.

A stock split doesn’t magically make you richer, but it often reflects the company’s confidence in its future. When Nvidia split in 2021, I noticed a surge in interest from new investors, and the trading volume on the stock rose significantly.

Here’s what I liked about it:

- My shares became more liquid and flexible

- The lower price reduced the barrier to entry for new buyers

- It sent a signal that Nvidia was performing well and growing

Of course, it’s important to remember that splits are cosmetic in nature. They don’t change fundamentals like earnings, profits, or valuation. But they can bring renewed energy to the stock.

How Does a US Stock Split Affect UK Investors Like Me?

As someone investing in the UK, I was glad to learn that the process is straightforward.

Here’s what happened to me:

- My UK broker (in this case, Freetrade) automatically reflected the split

- There were no fees, no tax implications, and no paperwork

- Since Nvidia is a US-listed company, the shares are still priced in USD, so currency exchange continues to apply

If you use other brokers like Trading 212, Hargreaves Lansdown, or eToro, the process is similar. They handle corporate actions like splits in the background, and your portfolio simply updates to show the new number of shares.

In short: there’s nothing for you to do—just keep an eye on your dashboard around the split date.

Will Nvidia’s Stock Split Affect Its Long-Term Value?

Looking at past performance, Nvidia has historically continued to perform well after a stock split. While the split itself doesn’t increase value, it often coincides with strong growth momentum.

From my perspective, the 2021 split gave the stock a boost. It allowed more retail investors to get involved and increased the company’s visibility. Analysts generally view splits as a bullish sign—especially when driven by strong fundamentals.

Given Nvidia’s leadership in AI, gaming GPUs, and data center hardware, its long-term prospects remain strong regardless of whether it splits again.

Still, I always remind myself not to make decisions based purely on a split. Fundamentals matter more than share count.

Final Thoughts: Should You Buy Nvidia Shares Before or After a Split?

If Nvidia does announce another stock split, the biggest question becomes: Do I buy before or after the split?

Here’s my take: buy when it aligns with your investment strategy, not based on timing a corporate action.

Buying before means you’ll end up with more shares post-split—but no increase in value. Buying after means the price per share will be lower, but again, the company remains the same.

In the end, the Nvidia stock split was a positive experience for me. It didn’t make me rich overnight, but it did make my portfolio feel more flexible. And it reminded me that even as a UK investor, I have easy access to global tech giants—and their growth stories.

If another split is announced, I’ll be watching—just like I was in 2021—but I’ll still base my decision on Nvidia’s performance, not just the price tag on a single share.