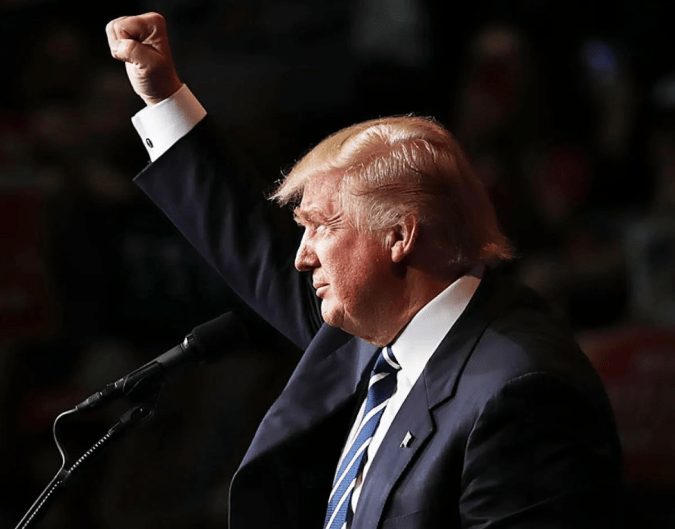

London’s FTSE 100 index opened significantly lower on Thursday, echoing sharp declines in global markets following the announcement of sweeping new tariffs by US President Donald Trump. The index fell by 122.4 points—or 1.4% —within minutes of the market opening.

Global Markets React to ‘Liberation Day’ Tariffs

The President’s declaration of a self-styled “liberation day” marked the introduction of substantial import duties on goods entering the United States, including a 10% tariff on UK exports.

The move sent shockwaves through global financial markets, with European indices experiencing even steeper drops. Germany’s DAX and France’s CAC 40 each fell by over 2%.

Asian markets had already borne the brunt of investor panic during overnight trading, with Japan’s Nikkei shedding nearly 3% and Hong Kong’s Hang Seng index down 1.5%.

Despite Wall Street finishing higher the previous evening, futures trading suggested a bleak outlook for the day ahead. All major US indices—the S&P 500, Nasdaq, and Dow Jones—were forecast to open in the red, with technology firms and retailers expected to take the biggest hit.

Meanwhile, gold surged to another record peak as investors sought refuge in safe-haven assets. The pound gained marginally against the weakening US dollar, climbing 0.01% to reach 1.292 USD, and held firm at 1.197 euros.

Matt Britzman, senior equity analyst at Hargreaves Lansdown, commented, “Trump’s bold attempt to reshape international trade has sent shockwaves through global markets.

The effects of ‘Liberation Day’ are being felt far and wide, with Asian markets down overnight, European stocks under pressure in early trading, and US futures pointing to a big drop later today.

With tariffs reaching levels unseen in over a century, the US is poised to rake in an additional 600 billion US dollars in tariff revenue in an optimistic scenario, or put that another way, that’d be a 600 billion dollar added cost for businesses or consumers to stomach.”

Uncertainty Breeds Caution Among Investors

The US dollar tumbled against major global currencies amid investor uncertainty surrounding the potential consequences of the tariffs and the likelihood of retaliatory measures from affected nations.

Chris Beauchamp, chief market analyst at IG, noted: “Investors and businesses are waking up to a new world this morning after Trump’s tariff announcement. Investors have voted with their feet and have resumed the selling of US stocks despite a small overnight bounce.”

He warned: “Should major partners like the EU impose higher costs then we can be certain the US will also respond in kind. Markets face the kind of trade war not seen for decades.”

Gold prices soared in response, with bullion—exempt from the new levies—surging to a historic high of over 3,167.84 USD per ounce before easing slightly by Thursday morning.

Linh Tran, market analyst at XS.com, explained: “Unlike previous trade tensions that mainly centred on US–China disputes, this round of tariffs is broader in scope, targeting multiple strategic industries such as electric vehicles, semiconductors, steel, and renewable energy.

This has raised concerns not only about potential retaliatory measures from affected countries but also about the possibility of a deeper fragmentation of global supply chains in the years ahead.

The market’s immediate reaction was a widespread shift into defensive mode, with capital flowing out of equities and risk assets and into gold – the traditional safe-haven asset.”

Oil prices also slumped, reflecting fears that the tariffs would stifle global economic growth and reduce demand for crude. Brent crude fell by more than 3% to 72.4 USD a barrel.