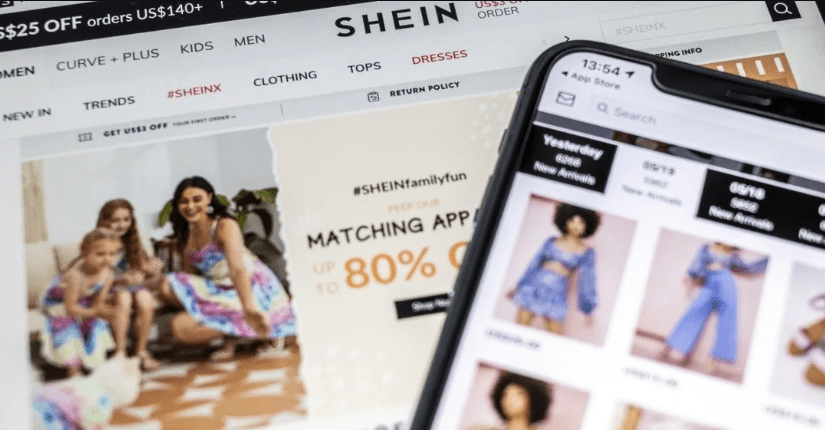

Online fashion retailer Shein has taken a pivotal step toward going public, having received approval from the UK’s Financial Conduct Authority (FCA) for its proposed Initial Public Offering (IPO) in London, according to sources familiar with the development.

The FCA’s authorisation represents a crucial milestone in the Singapore-headquartered company’s bid for a London listing, following its confidential IPO filing with the British regulator in June 2023. However, the IPO journey is far from over, as Shein must now await approval from Chinese regulators before proceeding.

Chinese regulatory approval is still pending

Despite moving its headquarters from Nanjing to Singapore in 2022, Shein is still subject to Beijing’s tightened overseas listing rules.

The company, which sells low-cost fashion items such as “US$10 dresses and US$12 jeans” to customers in more than 150 countries, was last valued at US$66 billion during a fundraising round in 2023.

A source revealed that Shein has already notified the China Securities Regulatory Commission (CSRC) of the FCA’s approval but has yet to secure the go-ahead from Beijing. The CSRC has not commented on the matter, and both Shein and the FCA have declined to respond to requests for further information.

Shein’s reliance on around 5,800 third-party contract manufacturers, predominantly based in China, means it falls under the jurisdiction of the CSRC’s rules, which apply a “substance over form” approach. This gives Chinese authorities considerable discretion in determining how and when regulations are enforced.

The company’s IPO application may also be scrutinised by other regulatory bodies, including China’s National Development and Reform Commission and the national cybersecurity authority, particularly given the cross-border nature of its operations.

Trade tensions, duty exemption changes could affect IPO timing

Further complicating Shein’s plans is the shifting geopolitical landscape. The Trump administration’s recent decision to impose 145 per cent tariffs on Chinese goods and eliminate the “de minimis” duty exemption for low-value imports is expected to have wide-ranging effects on Shein’s business model.

This exemption, which had allowed individual shipments under US$800 to enter the US duty-free, has been a cornerstone of Shein’s ability to offer competitively priced fashion in its largest market. The change, effective from 2 May, may necessitate price increases, potentially weakening its value proposition in the US.

Although Shein has sought to mitigate the impact by expanding its supplier base in Brazil and Turkey, the policy shift has cast uncertainty over the company’s IPO timeline. According to sources, Shein’s original goal of a first-half 2025 listing may now be postponed to the latter part of the year.

In light of the evolving regulatory and market conditions, Shein is reportedly considering a revised IPO valuation of around US$50 billion, a significant drop from its previous US$66 billion mark. The final valuation will likely depend on how the changes to US trade policy affect its business operations and growth prospects.

Market instability, spurred by rising inflation concerns and weakening US consumer spending, has already led other major firms like Klarna to delay their own listings. This volatility further complicates Shein’s path to the London Stock Exchange.

Previously, Shein had explored a US IPO, but shelved those plans due to mounting scrutiny from American lawmakers over alleged labour practices within its supply chain. The company maintains that it enforces “a zero tolerance policy for forced labour and child labour in its supply chain.”

As Shein continues to navigate both domestic and international hurdles, its IPO remains one of the most closely watched public offerings in the global fashion and e-commerce sectors.