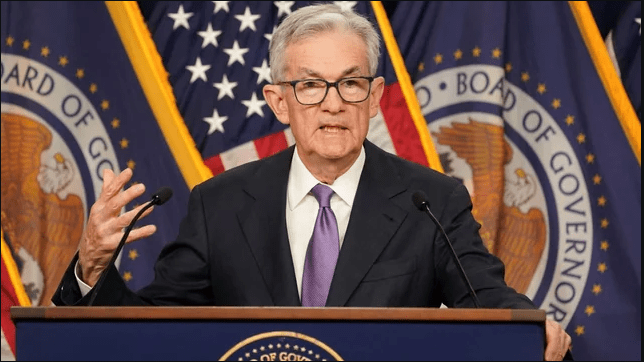

In a dramatic turn of events, US financial markets took a sharp nosedive following a fresh wave of criticism by former President Donald Trump aimed at Federal Reserve Chair Jerome Powell.

Trump lashed out on social media, labelling Powell “a major loser” and urging the Fed to slash interest rates “pre-emptively” in a bid to bolster a fragile US economy. “There can be a SLOWING of the economy unless Mr. Too Late, a major loser, lowers interest rates, NOW,” Trump posted.

The reaction was swift and severe. On Monday, the S&P 500 tumbled 2.4%, bringing its year-to-date losses to around 12%. The Dow Jones Industrial Average mirrored the drop, also falling 2.4%, while the tech-heavy Nasdaq slipped over 2.5%, now down approximately 18% since January.

The US dollar, typically seen as a safe haven in turbulent times, buckled under the weight of political tension and investor uncertainty. The dollar index, which measures the greenback against a basket of global currencies, fell to its lowest point since 2022.

Bond markets didn’t offer much comfort either. Yields on US Treasuries climbed further, reflecting growing investor anxiety and a demand for higher returns amid inflationary pressures.

The tremors were felt worldwide.

- In Asia, Japan’s Nikkei 225 closed marginally down by 0.1%, while Australia’s ASX 200 dipped 0.3%.

- Hong Kong’s Hang Seng managed a slight gain, rising 0.3%.

- Over in Europe, early trading saw London’s FTSE 100 edge down by just 0.05%, with sharper drops in Germany’s DAX (-0.5%) and France’s CAC (-0.6%).

Despite its typical safe-haven status, the US dollar joined the slide, even as gold surged to a record high of $3,500 (£2,613) per ounce — a clear signal that investors are shifting towards assets perceived as more stable during stormy times.

For a deeper analysis on where gold prices could head next, you can read our XAU/USD Weekly Forecast for April 21–25, 2025, which breaks down the latest market signals and trading opportunities for the week ahead.

Trump vs Powell: A Bitter History

Trump’s ongoing clash with Powell is nothing new. Since his appointment during Trump’s first term, Powell has faced repeated attacks from the former president.

Most recently, Trump took to social media demanding Powell’s removal, stating: “Powell’s termination cannot come fast enough.”

While such a dismissal would be highly contentious and legally dubious, it has reportedly been under consideration, with Trump’s economic advisers actively reviewing the possibility, particularly troubling given the Fed’s long-standing independence from political influence.

Powell, for his part, has maintained that he does not believe the president has the legal grounds to fire him.

Experts are sounding the alarm over potential long-term consequences. Christopher Meissner, an economics professor at the University of California, Davis, warned of a worrying trend: “Central bank independence is the key to financial stability and low inflation. And I think this is a major reversal and we have to watch out for it.”

Susannah Streeter of Hargreaves Lansdown echoed similar concerns: “The independence of central banks is seen as critical to ensure long-term price stability, ringfencing policymakers from short-term political pressures.”

She further noted that the current direction of US economic policy is unnerving global investors: “Yields on 10–year US Treasuries have held onto their recent rise above 4.4%… flags the anxiety rattling through the markets right now.”

What’s Next?

All eyes are now on Washington, where the IMF and World Bank are holding their spring meetings. The IMF is expected to release updated economic forecasts, with “notable markdowns” already anticipated.

Meissner summed up the global unease succinctly: “They used to say ‘When the US sneezed, the rest of the world caught a cold’… people are expecting a pretty significant downturn in the US in the coming months… and that can’t be good for the rest of the world.”

Conclusion

With markets tumbling, the dollar weakening, and political interference clouding economic policy, confidence in the US financial system appears to be waning. As the global economy watches on, one thing is certain: the clash between politics and central banking is far from over, and the stakes couldn’t be higher.